Earlier this year, your Board of County Commissioners – acting as the County Board of Equalization – approved a 4% across-the-board reduction to residential property values. Today, the State Board of Equalization rescinded that reduction.

The Board of Douglas County Commissioners will host a news conference to discuss the impact of this State decision on Douglas County homeowners.

“The state property tax system is broken. A five-person political board just stole $28 million of tax relief from our residents, by acting outside the law. We will appeal,” the Board of County Commissioners said in a unanimous statement in response to the State Board of Equalization’s decision today.

What: Discussion of property taxes and the impact of the State Board of Equalization’s decision to rescind Douglas County’s 4% reduction in residential property values.

When: 11 a.m. Tuesday, Dec. 19

Where:

- Attend Live: Board of Douglas County Commissioner’s Hearing Room at the Philip S. Miller Building, 100 Third St. in Castle Rock

- Watch the livestream on YouTube

- Participate via Webex Events by clicking here (the link will be activated before the meeting) complete the registration information and enter the password – BOCC (2622 from phones and video systems)

Participate via Telephone at 720-650-7664 United States Toll (Denver) and enter the access code: 248 618 17305

Speakers:

- Board of Douglas County Commissioners

- Douglas County Assessor Toby Damisch

Background

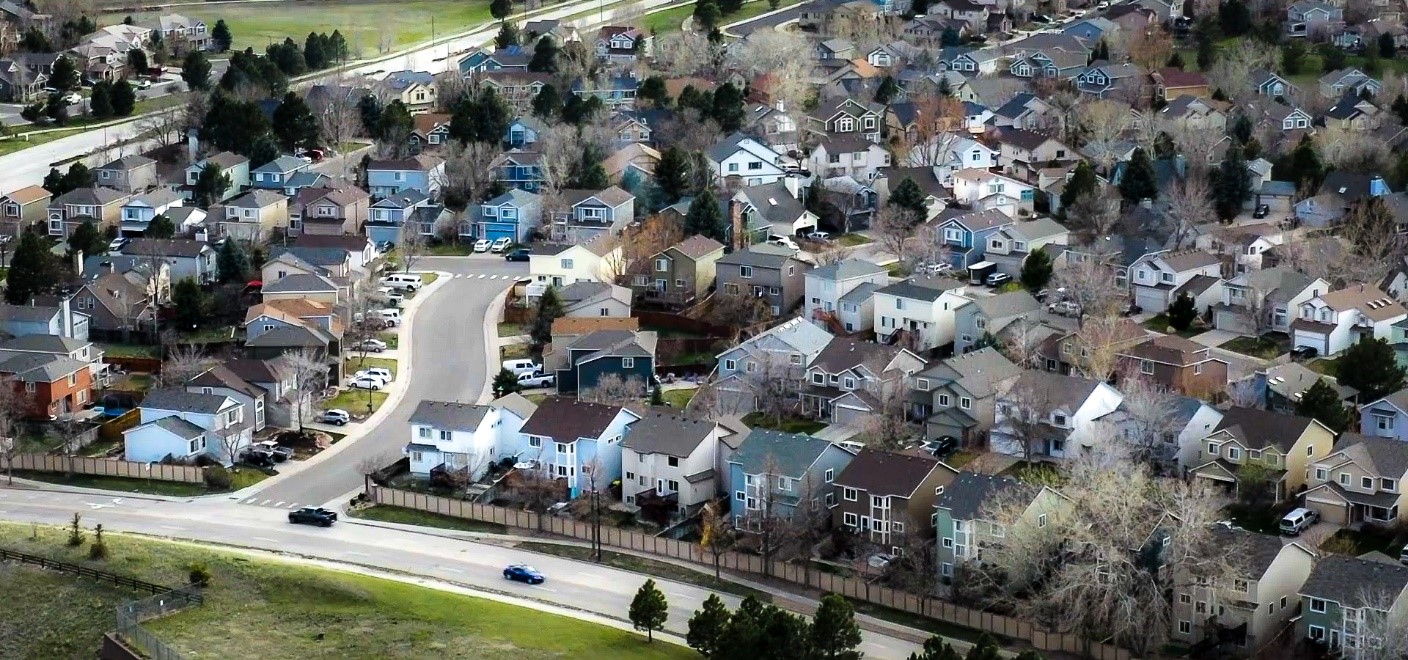

In September, The Board of Douglas County Commissioners, in its capacity as the County Board of Equalization (CBOE), approved Douglas County Assessor Toby Damisch’s recommendation for an across-the-board reduction of 4% in residential property values, providing an average of $223 in estimated property tax relief for Douglas County homeowners.

The State Board of Equalization consists of the Governor, the President of the Senate, the Speaker of the House of Representatives, or their designees, and two members appointed by the Governor with consent of the Senate. According to State Law, the Board has the power to review the valuations determined for assessment of taxes upon the various classes of real and personal property located within the counties of the state.