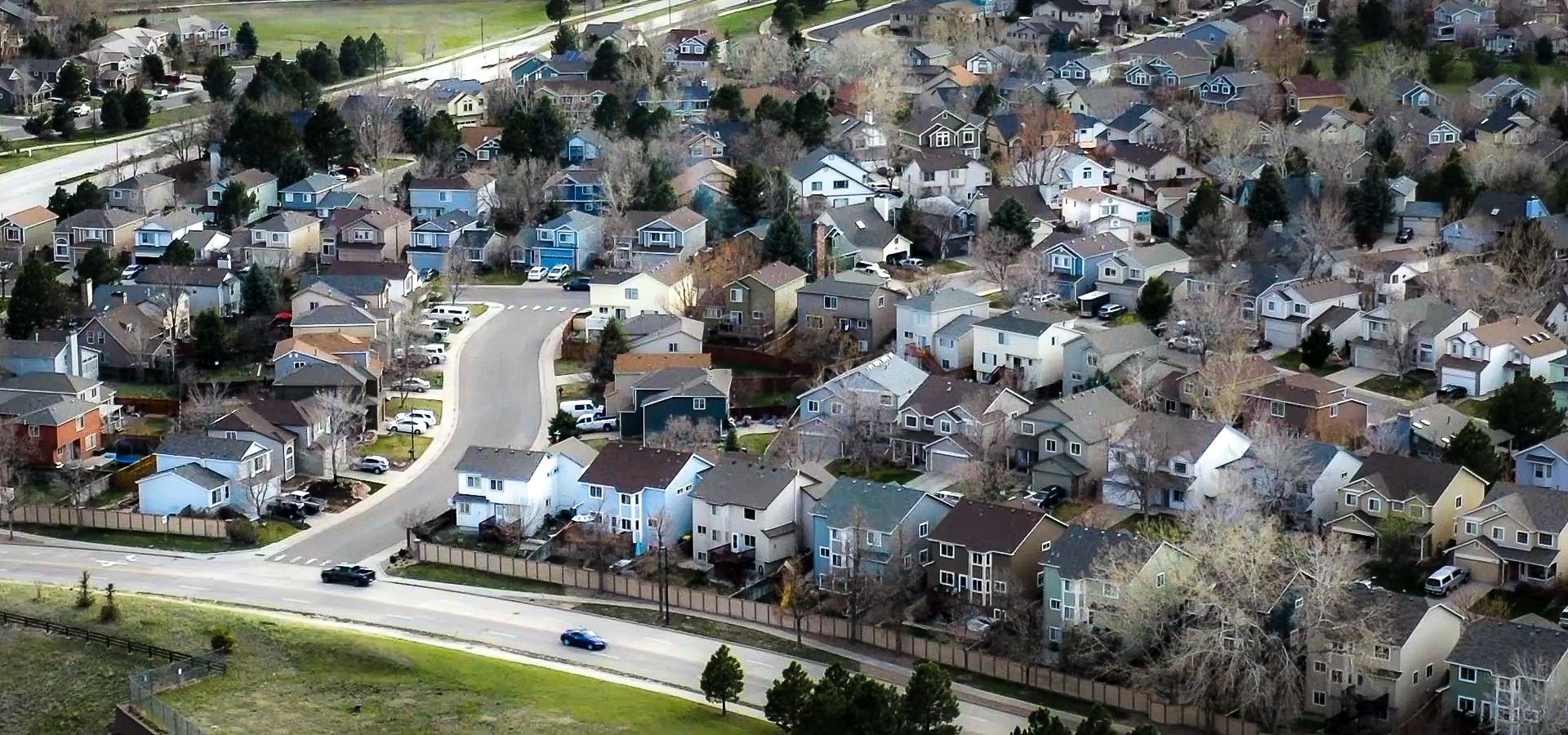

If you own a single-family home, townhome or condo in Douglas County, there is good news to share today.

The Board of Douglas County Commissioners, in its capacity as the County Board of Equalization (CBOE), today approved Douglas County Assessor Toby Damisch’s recommendation for an across-the-board reduction of 4% in assessments for single family residential property owners, providing an average of $223 in estimated property tax relief for Douglas County homeowners.

This is an aggregate tax reduction of approximately $28 million for residential property owners in Douglas County, those who were the most impacted by the 2023 Assessed Values Process per state law. The reduction in property values will also reduce tax revenue increases for many taxing authorities with a mill levy providing services to a residential property.

The County is hosting a Taxing Authorities Summit on Sept. 25 from 4-6 p.m. to engage a discussion among the Authorities regarding how to mitigate the rise in property taxes on single family residential property owners and to maximize public awareness of and public engagement in the Board of County Commissioner’s appeal to Douglas County taxing authorities for property tax relief.

“This year, our homeowners are experiencing the most impactful property reassessment in Colorado history,” said Assessor Toby Damisch. “The assessed value of most homes in Douglas County increased between 30% and 60%. As a result, about one in every four homeowners in Douglas County filed an appeal. We are seeing and experiencing the desperate need for relief.”

“Today I have the privilege of reporting back to you the findings of my Office’s research regarding the prospect of the CBOE enacting a broadly applied adjustment to the 2023 assessments of residential properties in our county,” said Damisch. “Our analysis indicates that this group of properties can and should be reduced by 4% in an action today by the CBOE.”

Residential property owners will see this reduction on their January 2024 property tax statement. Overall, 125,809 parcels will be reduced.

“This is the good work of the county that I will continue to stay focused on,” said Commissioner Abe Laydon. “The estimated $28 million reduction in your property taxes will be in addition to what we have already been working on to decrease your tax burden and keep Douglas County fiscally conservative, including annual historic mill levy reductions, hosting property tax town halls for thousands, legally challenging Proposition HH, and hosting a Property Tax Summit next week, further encouraging special districts to also reduce your tax burden. Tremendous thanks to the leadership and expertise of our friend and colleague Assessor Toby Damisch.”

“Providing tax relief to our residents is our No. 1 consideration this year,” said Commissioner George Teal. “I appreciate Assessor Damisch bringing us this suggestion, so we could take action on this unprecedented rise in assessed property values.”

“I’m grateful on behalf of residential property owners in Douglas County that Assessor Damisch and his team are providing real property tax relief (for them),” said Commissioner Lora Thomas. “Voters need to remember this, and vote NO on Proposition HH in November, which is a tax increase that also ends TABOR refunds.”

Earlier this year, 33,002 Douglas County property owners filed appeals on 36,305 real property parcels. Of those, nearly 32,000 were related to residences, including single family attached and detached homes, condominiums, and townhomes. This is triple the next highest year of appeals, according to Assessor Damisch’s Report to the CBOE.

This data led to the Assessor’s proposal approved today by the Board of Equalization, which is allowed under State law.

State law governs the reappraisal process, which is implemented at the County level. Under Colorado law, the Board of County Commissioners, acting as the County Board of Equalization, has the right to apply adjustments to the Actual Value of Real Property, where they see fit, necessary, or just, so long as the reduction complies with the state constitution, Title 39, and Colorado assessment audit requirements.

Watch today’s special meeting of the Board of Equalization. Read the Assessor’s report and recommendation to the CBOE.