Do you own property in Douglas County? You are likely hearing about a historic increase in your next assessment. Your County wants to be transparent about this topic, so please read on.

Odd-numbered years are reappraisal years in the state of Colorado. All real property is reviewed, and new values are established for taxation purposes. State law governs this process, and your local county assessor implements it.

In accordance with those laws, the Douglas County Assessor’s Office publishes Notices of Valuation to property owners on May 1 to inform you of your updated property valuation and advise you of your right to appeal. Your notice is being mailed to you and is now available online.

In 2023, these notices reflect real property values as of June 30, 2022 – for which property taxes will be owed in early 2024. This year’s notices will reflect an increase of 30% to 60% for residential property, as well as significant increases in other property classes. The higher assessments reflect the extraordinary inflation experienced in the real estate market between June 2020 and June 2022.

“This reappraisal year is unlike anything we’ve seen historically,” said Douglas County Assessor Toby Damisch. “We want you to know we are advocating for a solution. But, in the meantime, the law requires us to send notices on May 1.”

Watch a Live Town Hall from April 26 to learn more. A follow-up Live Town Hall is planned for 6 p.m. Wednesday, May 24.

So what can you do?

View updated property values on the Douglas County Assessor’s website, along with information about what makes 2023 unique, how your property was appraised, and your options for appeal.

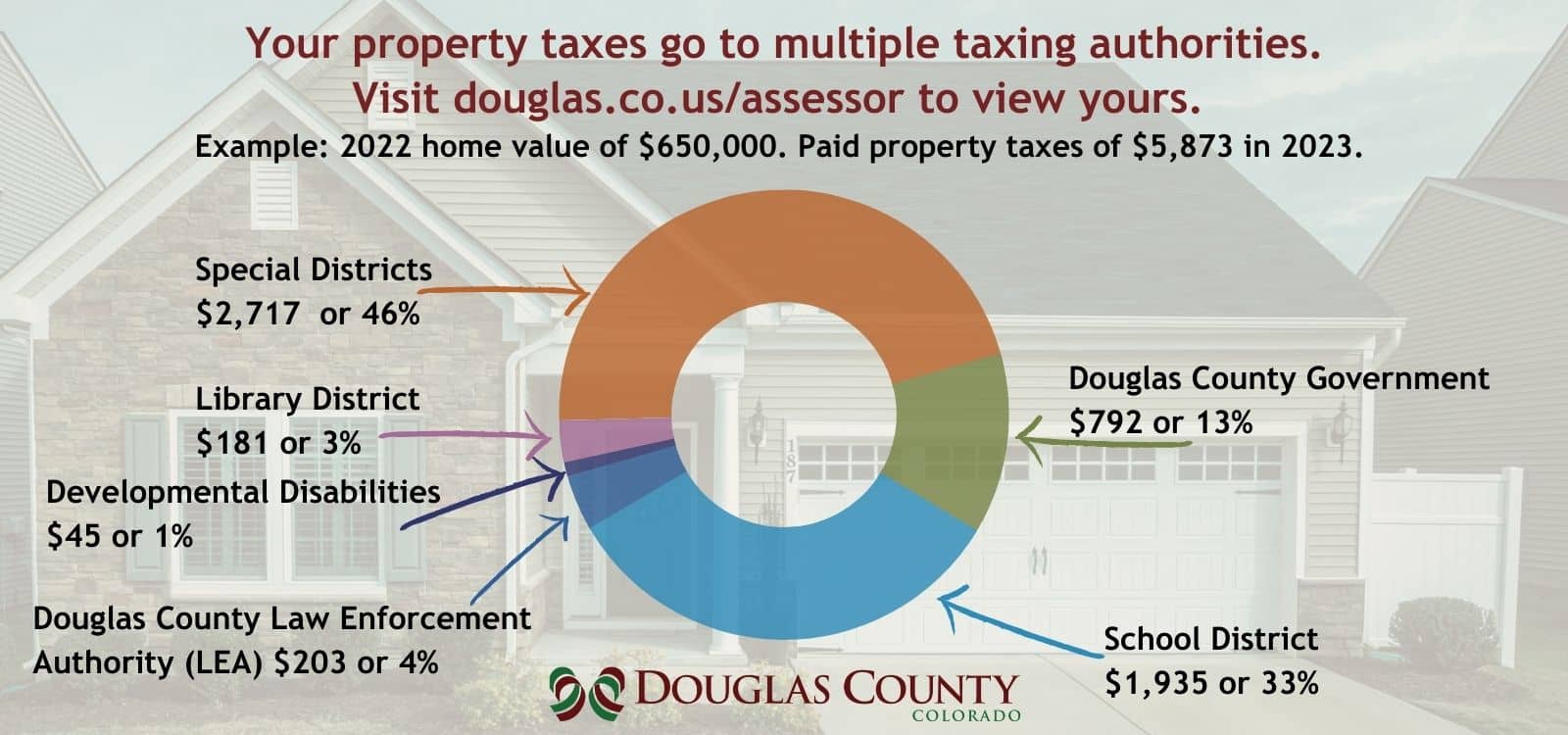

Understand where your property tax goes. While property taxes are paid to the Douglas County Treasurer, the full amount does not stay with the County. It also is distributed to more than 300 taxing entities within the county, such as the school district, the library, metro districts, fire districts and water districts – each with the responsibility of setting their own mill levies. Visit douglas.co.us/assessor and type in your address at the top of the page for a look at your property specifically.

Appeal your 2023 assessment. If you know your home would not have sold for the new amount last spring, you should file an appeal. Visit the Douglas County Assessor’s website, or call 303-660-7450 to make an in-person appointment. The deadline to appeal is June 8.

Contact your state representatives: The Douglas County Assessor is required to implement the state law that governs this process, so any changes must be made at the state level. Contact your state representatives with your concerns. Find out who represents you on our interactive map.