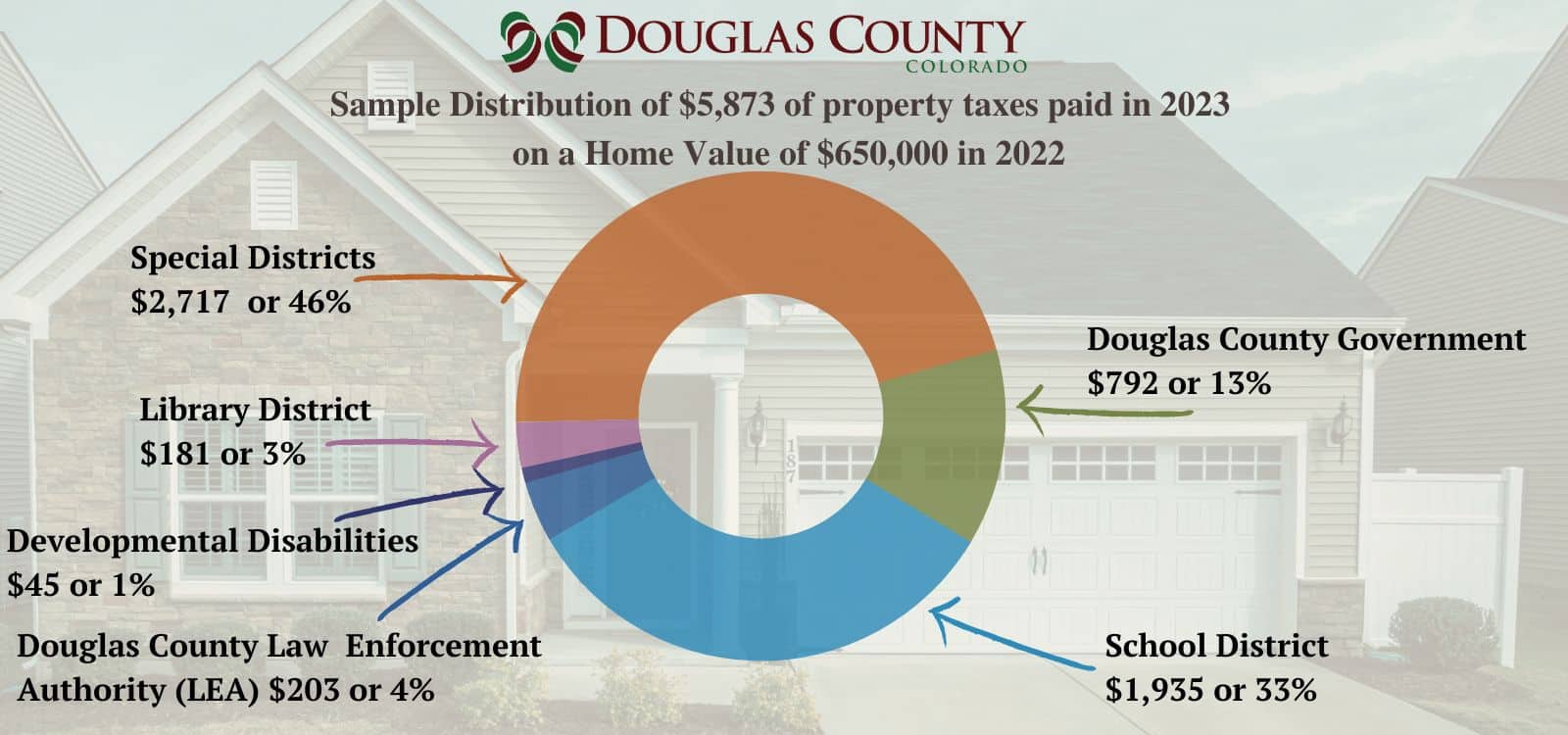

The numbers in this chart represent actual property taxes assessed in 2022 and paid in 2023 for an average Douglas County home with a value of $650,000.

How are your property taxes assessed? How has the housing market impacted your home’s taxable value? And where does the money go, anyway? You have questions about your property taxes, and your county government wants to answer them.

Odd-numbered years are reappraisal years in the state of Colorado. All real property is reviewed, and new values are established for taxation purposes. In May of reassessment years, all property owners are sent a Notice of Valuation (NOV). The purpose of the NOV is to inform you of any increase or decrease in your property valuation and advise you of your right to appeal the new value.

The Douglas County Assessor’s Office publishes Notices of Valuation to property owners on May 1. This year, these notices reflect real property values as of June 30, 2022 – for which property taxes will be owed in early 2024. State law governs this process, and your local county assessor implements it.

This year’s notices will reflect an increase of between 30% and 60%. We know that made you flinch, so please plan to join your Board of Douglas County Commissioners and Douglas County Assessor Toby Damisch for a Live Town Hall about the 2023 reappraisal and property taxes at 6 p.m. on Wednesday, April 26.

“We know from our 2023 Citizen Survey that there is a historic level of concern about taxes in Douglas County,” said Commissioner Lora Thomas. “During this Live Town Hall, we want to help everyone understand the current situation and what can be done about it.”

“An increase in assessed value on properties statewide will compound our community’s voiced concern about taxes,” said Assessor Damisch. “I hope you’ll bring your questions to this Live Town Hall.”

The Live Town Hall will be via phone, online and in person at the Philip S. Miller Building, 100 Third St. in Castle Rock. Join online at douglas.co.us/townhall or via phone by calling 833-380-0668, or simply answer the phone when we call to invite you to join us. To receive a call just before a Live Town Hall begins, visit douglas.co.us/townhall to register.

While property taxes are paid to the Douglas County Treasurer, the full amount does not stay with the County. It also is distributed to more than 300 different taxing entities within the county, such as the school district, the library, special districts, fire districts and water districts.

Visit douglas.co.us/assessor and type in your address at the top of the page for a look at exactly where your funding goes. To understand more about what makes 2023 unique and the options to appeal, visit our web page.